.

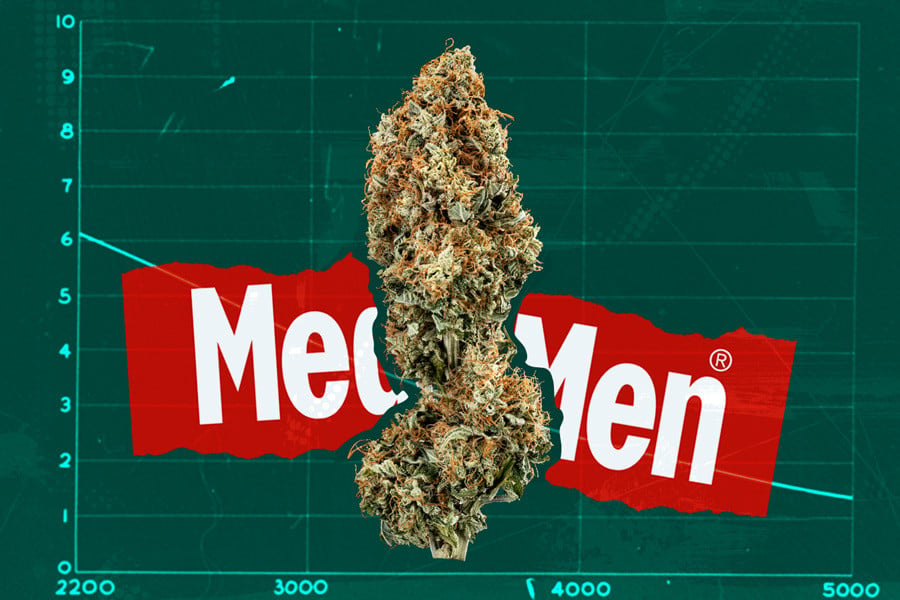

The Rise and Fall of MedMen

MedMen, once valued at $3 billion dollars, is no more. Here we look at their story, explore what went wrong, and ask what it can tell us about the fate of the wider cannabis industry.

Contents:

MedMen was, for a short while, a prominent and respected name in the US legal cannabis industry, temporarily known as the "Apple store of weed" before taking on the less complimentary moniker: “DeadMen”. The implication of being moribund turned out to be a harbinger of doom, and the company is, alas, no more.

The comparison with Apple wasn't meaningless, reflecting MedMen’s bold, customer-facing vision. Their stores offered a high-end shopping experience that set a new standard in cannabis retail and offered a vision of how the future could look. However, despite their initial success, MedMen's story took a drastic and devastating turn towards financial instability, administrative issues, and bankruptcy, transforming the company from an industry leader into a cautionary tale.

Here, we take a look at the turbulent history of MedMen, explore what actually happened, and ask what it might be able to tell us about the future of the legal cannabis industry.

Who Were MedMen?

Founded in 2010 by Adam Bierman and Andrew Modlin, MedMen stood out in the burgeoning legal cannabis market due to its sleek branding and upscale dispensaries. All the while, it distanced itself from stereotypical tropes about cannabis and cannabis users. Bierman and Modlin set out to manifest their bold vision of the cannabis industry, and for a time it proved very popular, at one point causing them to be valued at $3 billion.

The company's contemporary approach to cannabis retail aimed to normalise the substance, making its purchase routine and positioning it in a new light, as an acceptable, desirable plant with a plethora of benefits in the modern world. Located in prime, cannabis-friendly locations such Venice Beach, CA, New York’s Fifth Avenue, and near the Las Vegas strip, MedMen's dispensaries showcased an array of cannabis products, from various strains to edibles and concentrates, in a modern, mainstream setting.

All of this sought to change perceptions around cannabis, invite in a broader customer base, and ultimately make money. At first, it looked highly promising. Fast-forward to the present day, and it was never to be.

Why Did MedMen Collapse?

The journey from rapid expansion to financial distress began subtly, but gained momentum over time before snowballing out of control. MedMen first entered the public market in 2018, eight years after their creation, with a share price of just above $3, and investors quickly doubled its value. For a brief moment, the future looked bright.

However, the expansion was costly and ultimately proved untenable. The company took on substantial debt, amounting to hundreds of millions of dollars, and even attempted a massive $682 million merger with PharmaCann, which ultimately fell apart due to antitrust scrutiny from the Department of Justice. This turned out to be a blow from which they would never recover.

By April 23rd, 2024, MedMen's financial challenges reached a terminus, resulting in the company entering into receivership. This development was a result of prolonged cash flow issues exacerbated by high operational costs, competitive pressures from unlicensed sellers, and an unforgiving market environment that intensified with regulatory concerns over vaping.

A Perfect Storm of Problems

The fall of MedMen can be traced back to a combination of poor decisions and external challenges—not all of which can be fairly laid at their feet.

Adam Bierman, one of the two co-founders, was compelled to step down amidst controversies, including accusations of racism and financial mismanagement, which tainted the company's reputation, spooking investors and customers alike. Furthermore, the legal cannabis market as a whole faced unexpected regulatory problems and subsequent investor scepticism due to public health developments. For example, issues with hazardous vape cartridges emerged, leading to increased scrutiny and regulatory pressure and undermining much of the wellness-focused marketing that the industry, as a whole, thrives on.

Despite a short-lived boost during the COVID-19 pandemic, the company could not overcome its fundamental financial burdens. Even before the pandemic, in 2019, MedMen's stock had more or less collapsed, losing 92% of its value—a decline from which it never recovered. Come the end, the company disclosed over $400 million in liabilities in its bankruptcy filings, a stark declaration of its dire position.

Does MedMen’s Demise Affect the Broader Weed Industry?

MedMen's dramatic rise and fall raises important questions about the sustainability of rapid expansion in the still-evolving legal cannabis industry. The company's fate serves as a cautionary tale about the dangers of overleverage and the importance of robust financial and operational management.

While the industry is certainly growing, operating in a fast-changing and inconsistently regulated industry poses serious risks. In fact, what we learn is that cannabis-related companies need to take baby steps where risk is involved, as it can be difficult to know what the future will look like, and sudden developments in such a volatile and stigmatised industry can spell doom.

However, MedMen’s story is also one of reckless ambition, and could be applied to any business, cannabis-related or not. Attempting to dominate the market, quickly, could pay off for a lucky few businesses, but it can also result in a spectacular implosion.

Goodbye to MedMen

So with MedMen gone, what can we learn? It’s dangerous to take too much away from a single company’s demise, but this unfortunate tale tells us two things—first, that the cannabis industry is volatile and risky; second, that rapid growth isn’t always good.

Despite the infamy of this company and their trajectory, there are many cannabis-related companies that are thriving, even at a time when the world’s economic outlook is quite bleak. So, while the industry still has a long way to go, if you tread carefully, business success is possible.