.

How Cannabis Is Reshaping the Alcohol Industry in 2025

As cannabis goes mainstream, alcohol sales are falling. Explore how health trends and legalization are fueling the shift—and how the booze industry is fighting back.

Contents:

- Reviewing the most used psychoactive substances

- Marijuana vs alcohol consumption trends in 2025

- Marijuana legalization's impact on the alcohol industry

- How alcohol companies are adapting to the cannabis boom

- Health comparisons between cannabis and alcohol

- Alcohol and cannabis: two industries with a changing future

Key Points

- Alcohol sales are falling in areas that have legalized cannabis.

- Consumers are switching for various reasons, including perceived health benefits.

- Alcohol companies are responding in creative ways, including brewing weed-infused beer.

- Discover the impact of cannabis on the alcohol industry below.

With the rapid ascent of the global cannabis industry over the last couple of decades, many people are forgoing a pint in favor of a joint. But just how many people are making the transition from beverage to bud? How is the alcohol industry responding? And is booze losing its long-held grip on social culture?

Reviewing the Most Used Psychoactive Substances

Humans have long had a penchant for consuming consciousness-altering substances, from subtle stimulants to full-blown hallucinogens. Industrialism and capitalism, paired with the principle of supply and demand, have seen the rise of gigantic industries that revolve around this desire to tweak our brain chemistry.

With 80% of adults using it regularly, caffeine[1] currently sits perched atop the throne as the most-consumed psychoactive substance across the world. Alcohol[2] ranks second, with 2.4 billion people regularly partaking.

Nicotine[3] comes in at third place with 1.3 billion regular users, and cannabis[4] in fourth position, boasting 147 million users (2.5% of the world’s population).

Cannabis: A Burgeoning Market

These are some mighty figures, which make for some pretty big markets! However, all of these substances produce distinct effects. While caffeine and nicotine are stimulants that get billions of people through a day of work, alcohol is a depressant that also works as a social lubricant. Then we have cannabis, which offers a much broader set of effects that depend on the strain in question.

Given the very real appeal of cannabis worldwide, many companies are beginning to take action, targeting this market. The above figures also suggest a brewing “market warfare” between the marijuana and alcohol camps.

But does cannabis really have what it takes to replace alcohol as one of the world’s favorite socializing substances? Find out below!

Marijuana vs Alcohol Consumption Trends in 2025

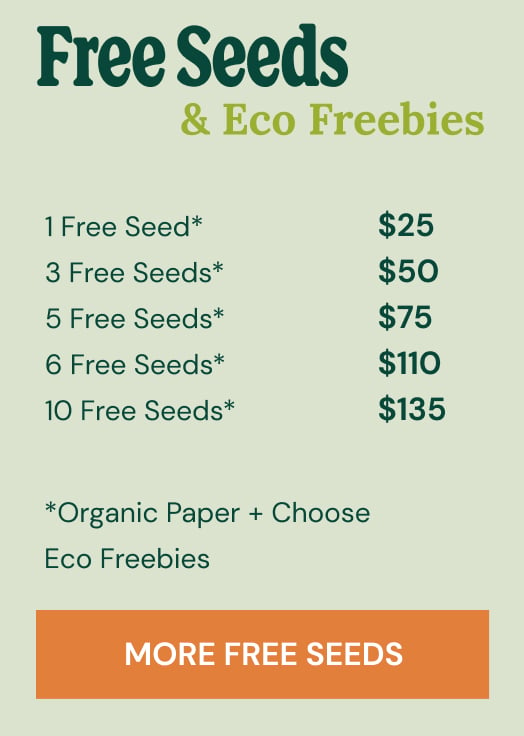

The growth of the global marijuana market shows no signs of waning, with the recreational, medical, and pharmaceutical markets continuing to boom. Worldwide, the market as a whole is forecast to reach a value of over $68 billion[5] by the end of 2025. With an estimated annual growth rate of 2.3%, this number will likely bloom to a staggering $75 billion by 2029.

So, how do these impressive numbers compare with those of the alcohol market[6]? Well, hold on to your hats, folks! The at-home revenue, including revenue generated in supermarkets and convenience stores, will amass $1 trillion in 2025.

In addition, the out-of-home revenue from pubs, clubs, bars, and cafes will likely top out at $685.8 billion. Together, these figures combine to just short of $1.7 trillion.

However, while the numbers for booze seem titanic, they’re actually shrinking. Despite these figures, analysts project a combined loss across at-home and out-of-home revenue of $283.6 billion.

So, the cannabis market is relatively small but growing, while the booze market is massive but shrinking. Why, then, are some people making the transition?

Why Are People Switching From Alcohol to Cannabis?

What is it about cannabis that makes some people ditch boozing for blazing so quickly? Check out some of the key reasons for this transition below:

- Perceived health benefits: Some individuals swap out alcohol for cannabis with the perception that it’s better for their health. While using cannabis certainly poses its own risks, especially when smoked, most statistics consider it to have a much lower toxicity than alcohol.

- Customizable effects: Wine, beer, and mead aficionados will tell you about the wonderful diversity of their drink of choice. However, cannabis takes customization to another level. There are thousands of strains to choose from and many ways to enjoy them, from smoking dried flowers to vaping extracts or consuming edibles.

- No hangover: Even after a night of non-stop smoking, you’re likely to wake up feeling a little groggy at worst. Now, compare this to a severe hangover that can leave you feeling groggy for days on end.

- Growing legal acceptance: In areas where marijuana has become legal, the ability to pop down the street to a dispensary or cannabis club has made the herb much more accessible.

- Holistic approach: Sure, some people brew their own booze, but it doesn’t grow from the soil in the same way. The ability to oversee a plant from seed to harvest puts weed users in touch with the entire production process.

Marijuana Legalization's Impact on the Alcohol Industry

Cannabis legalization appears to be reducing alcohol use in certain areas around the globe. A 2024 research paper[7] looked at the impact of non-medical cannabis legalization on alcohol sales in Canada. The authors found a reduction in beer sales in all except the Atlantic provinces.

Researchers have also noticed a similar trend in the United States. Findings published by NORML suggest[8] that counties located in medical cannabis jurisdictions experienced an average reduction in monthly alcohol sales of 15% after legislation changes.

Furthermore, market analysts have called marijuana[9] legalization a “significant threat” to the alcohol industry, based on findings that people are continually substituting marijuana for beer.

Overall, access to marijuana—even in medical-only states—seems to correlate with people choosing bud over Budweiser.

How Alcohol Companies Are Adapting to the Cannabis Boom

In response to this shift, are alcohol companies investing in the cannabis market? While some large companies have made strategic moves into the weed industry, others are resisting the green wave.

Constellation Brands, the company that brews Corona, invested billions in the Canadian cannabis company Canopy Growth. However, these ventures don’t always work out. Reports[10] in 2024 suggest Constellation Brands moved to distance itself from Canopy Growth following a “failed $4 billion investment”.

Other companies are taking a slightly different approach; instead of moving into the cannabis industry, they’re attempting to pull weed into their own territory.

Cannabis-Infused Alcoholic (and Non-Alcoholic) Drinks

If you’ve ever spent a night blazing and drinking, you’ll know first-hand that weed and booze don’t always mix. That said, some major alcohol companies have looked to invest in the creation of alcohol and non-alcoholic cannabis beverages, including those containing both CBD and THC.

Pioneering alcohol companies, including Molson Coors[11] and AB InBev[12] (Budweiser’s parent company), dipped their toes into the world of cannabis-infused alcoholic drinks in the late 2010s by partnering with major cannabis companies, but both appeared to have ended their partnerships in recent years.

That said, there has been a rise in THC-infused alcoholic and non-alcoholic beverages, including THC seltzers from companies like CANN and Wynk.

Health Comparisons Between Cannabis and Alcohol

Before making the switch from alcohol to weed, many users often wonder about the associated health implications. Many people view cannabis as a healthier choice owing to calorie-free consumption (edibles excluded) and the fact it doesn’t harm the liver in the same way.

Now, alcohol is certainly more toxic due to its potential for fatal overdose. The substance also produces much more severe withdrawal symptoms.

However, smoking and vaping cannabis both pose health risks to users. Plus, many people find themselves vastly exceeding their recommended daily calorie consumption while battling with the munchies.

While cannabis provides a potentially safer experience overall, it doesn't come without its own health risks, which scientists and doctors have yet to fully understand[13].

Alcohol and Cannabis: Two Industries With a Changing Future

The cannabis revolution isn’t just changing laws—it’s changing lifestyles. As 2025 unfolds, one thing is clear: cannabis isn’t just competing with alcohol, it’s redefining what it means to unwind, celebrate, and socialize in a changing world.

This shift has sent big ripples out into the alcohol industry, and it will be interesting to see how they respond over the coming years. Weed-infused drinks certainly have the potential to become popular, but their popularity could fade as their novelty wanes.

As legalization continues to spread across the world, we could see even more far-reaching ramifications of this phenomenon among alcohol companies who had an almost monopolistic grip over recreational culture last century.

- https://www.camh.ca/en/health-info/mental-illness-and-addiction-index/caffeine

- https://britishlivertrust.org.uk/the-lancet-alcohol-associated-2-8-million-deaths-annually-worldwide

- https://www.who.int/news-room/fact-sheets/detail/tobacco

- https://www.who.int/teams/mental-health-and-substance-use/alcohol-drugs-and-addictive-behaviours/drugs-psychoactive/cannabis

- https://www.statista.com/outlook/hmo/cannabis/worldwide

- https://www.statista.com/outlook/cmo/alcoholic-drinks/worldwide

- https://pubmed.ncbi.nlm.nih.gov/38460325/

- https://norml.org/news/2017/12/07/study-alcohol-sales-fall-following-cannabis-legalization

- https://ground.news/article/marijuana-legalization-is-a-significant-threat-to-alcohol-industry-because-people-substitute-cannabis-for-beer-and-wine-analysis-finds

- https://www.fooddive.com/news/constellation-canopy-growth-shares-distancing-board-non-voting-biden-fda-regulation-cannabis/713734/

- https://drinks-intel.com/news/molson-coors-beverage-co-steps-away-from-cannabis-with-truss-beverage-co-offload/

- https://www.inside.beer/news/detail/belgium-usa-canada-ab-inbev-stands-before-the-ruins-of-its-cannabis-project

- https://scitechdaily.com/new-research-uncovers-alarming-heart-risks-for-marijuana-users/